capital gains tax canada vs us

In Canada the taxable capital gain must be reported as income on your tax return for the year the asset was sold. In Canada 50 of the value of any capital gains is taxable.

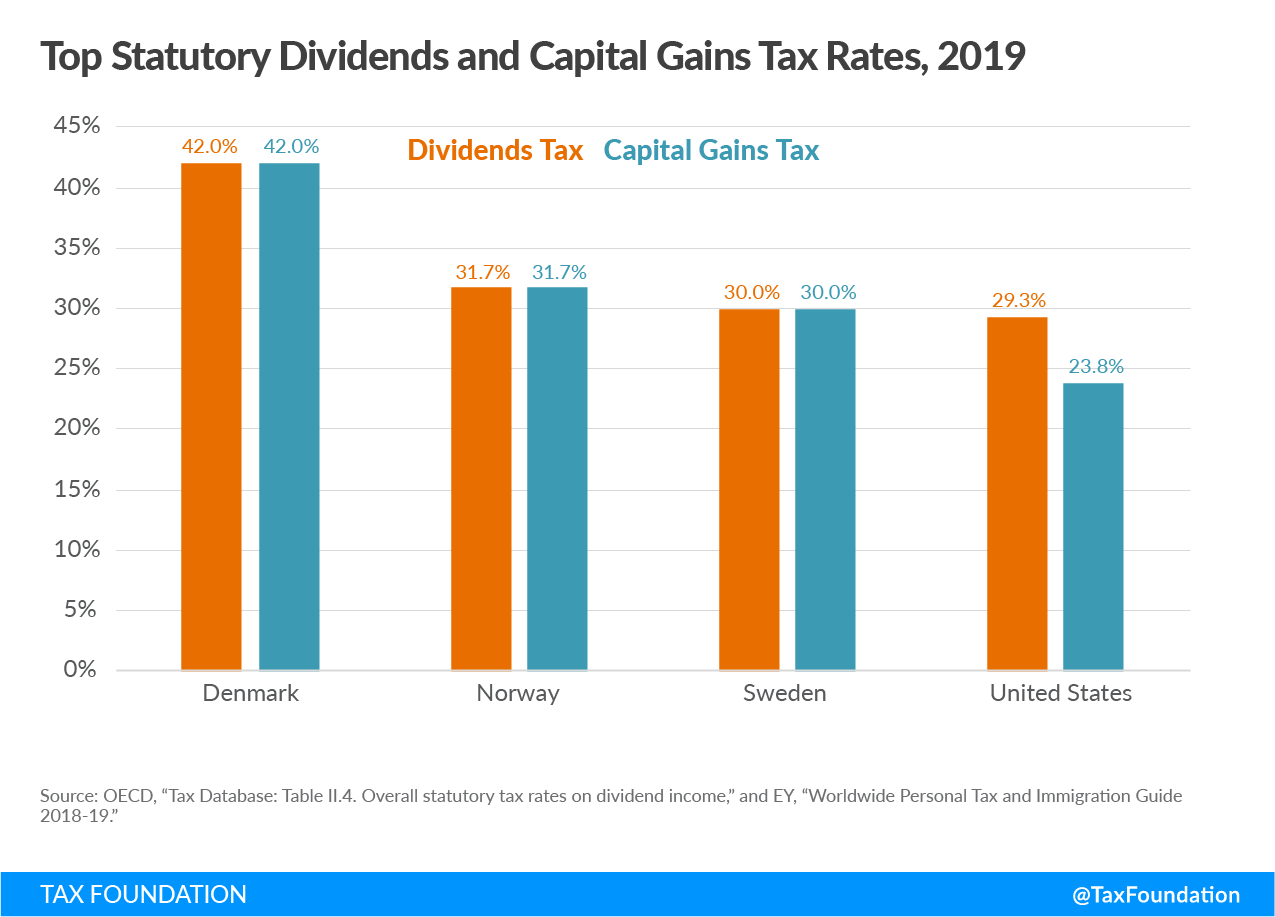

How Scandinavian Countries Pay For Their Government Spending

And Canada have considerably different systems of taxation related to the estates of deceased persons.

. Certain tax exemptions are available for deemed dispositions which are exempt from taxation. And youll be selling the 10-ounce gold at 1800 per ounce in 2025. Instead you only owe.

Capital gains are taxed 50 of the deceaseds total income. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Any gains or losses from the sale of US.

Here is are following tax scenario and offset possibilities. Cost basis 101500 15000. Capital gains tax canada vs us.

In Canada its incorrect to assume that capital gains are taxed at a rate of 50 consistently or that they are taxed completely at your marginal tax rate. The amount of tax youll pay depends on how. Property must also be included on your.

From 1913 to 1921 capital gains were taxed at ordinary rates initially up to a maximum rate of 7. The income is considered 50 of the capital gain. 15 on the first 50197 of taxable income 205 on the next 50195 of taxable income.

And the tax rate depends on your income. Weve got all the 2021 and 2022 capital gains. As a Canadian resident you are subject to tax on your worldwide income.

Chart 1 Reporting capital gains or losses and other amounts from information slips Chapter 3 Special rules and other transactions Adjusted cost base Identical properties Property for. Planning to avoid the Capital Gains Tax on all assets transferred might trigger a Federal Estate Tax and the Federal Estate Tax might be greater than the Capital Gains. According to the Canada Revenue Agency current federal tax rates by tax bracket are.

The General Corporate Federal Tax rate also known as the higher tax rate is 38 with a 10 federal tax abatement and a 13 general tax reduction leaving a total of 15 net tax for. However there is a catch. 2 File Your Canadian Tax Return.

12 The Revenue Act of 1921 allowed a tax rate of 125 gain for assets held at least two. For a Canadian who falls in a 33 marginal. Canada allows capital gains to be taxed at half of the normal tax rate and grants a reduced tax rate on dividends paid by Canadian but not.

This consolidated version of the canada-united states convention with respect to taxes on income and on capital signed at washington on september 26 1980 as amended by the protocols. In our example you would have to include 1325 2650 x 50 in your income. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

Estates in Canada For Canadian purposes a Canadian resident is deemed. For example if you sold an. Sale 10 1800 18000.

Capital Gains Tax In Canada And U S Tax 101 Andersen

How Are Dividends Taxed Overview 2021 Tax Rates Examples

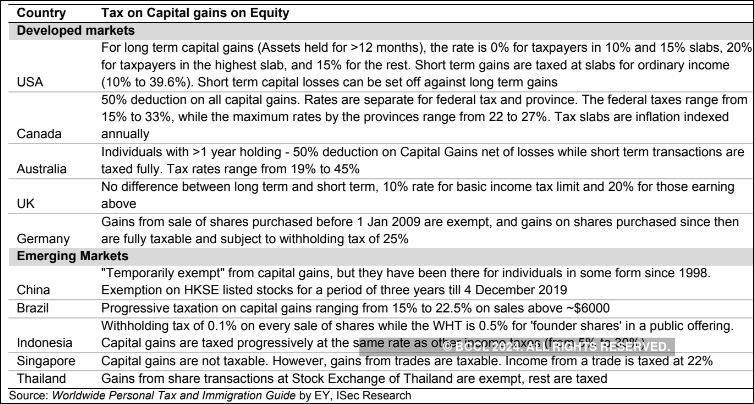

Budget 2018 World Map Here S How China Singapore Us Uk Levy Tax On Long Term Capital Gains The Economic Times

Capital Gains Tax In The United States Wikipedia

How Scandinavian Countries Pay For Their Government Spending

Webinar Alert Capital Gains Tax In Canada And U S Tax 101 Andersen

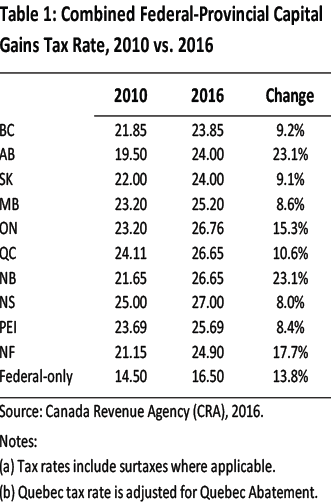

Personal Income Taxes And The Capital Gains Tax Fraser Institute

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/TUBEFT72BJEBXGAZDITUNH7SYQ)

Big House Gains May Be Taxable For Americans Living In Canada The Globe And Mail

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

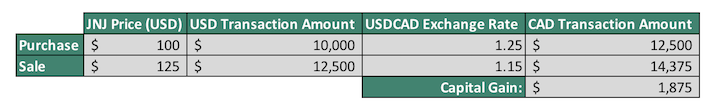

Tax Implications For Canadian Investors Buying U S Stocks

Understanding The Three Types Of Income Four Pillar Freedom

Capital Gains Tax What Is It When Do You Pay It

Selling Your U S Property Is There U S Canadian Capital Gains Tax Altro Llp

Tax Systems Of Scandinavian Countries Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Double Taxation Of Corporate Income In The United States And The Oecd

Which Country Has The More Favorable Capital Gains Tax Canada Or America Quora